Altcoins outperforming Bitcoin, especially on a BTC-relative basis, show capital rotation actually shows up on-chain because Bitcoin remains the benchmark asset in crypto. In 2026, this dynamic is clearer than ever. A small group of altcoins are consistently delivering stronger relative performance than BTC, driven by clear narratives, real usage, and ecosystem growth.

These are not random pumps. They are assets benefiting from structural demand, sector dominance, and recurring capital inflows during risk-on phases.

Below are the top altcoins outperforming Bitcoin in 2026, based on relative strength and narrative-driven adoption.

Why Compare Altcoins to Bitcoin?

Before I get into the list, it’s worth asking: why measure altcoins against Bitcoin in the first place?

The reason is simple. Bitcoin is still the “reserve currency” of crypto. It’s the measuring stick. If an altcoin can consistently beat Bitcoin’s performance, it’s telling us something important. It’s showing us either that adoption is growing faster, speculation is stronger, or utility is breaking through into new areas.

This year, Bitcoin’s year-to-date returns hover around 18%. Respectable, yes, but not headline-making. Meanwhile, several altcoins are posting double, triple, and in some cases even higher returns. And that’s not just raw numbers; it’s tied to narratives like legal clarity, DeFi dominance, retail adoption, and yes, a bit of good old-fashioned hype.

Now let’s break down the leaders of 2026.

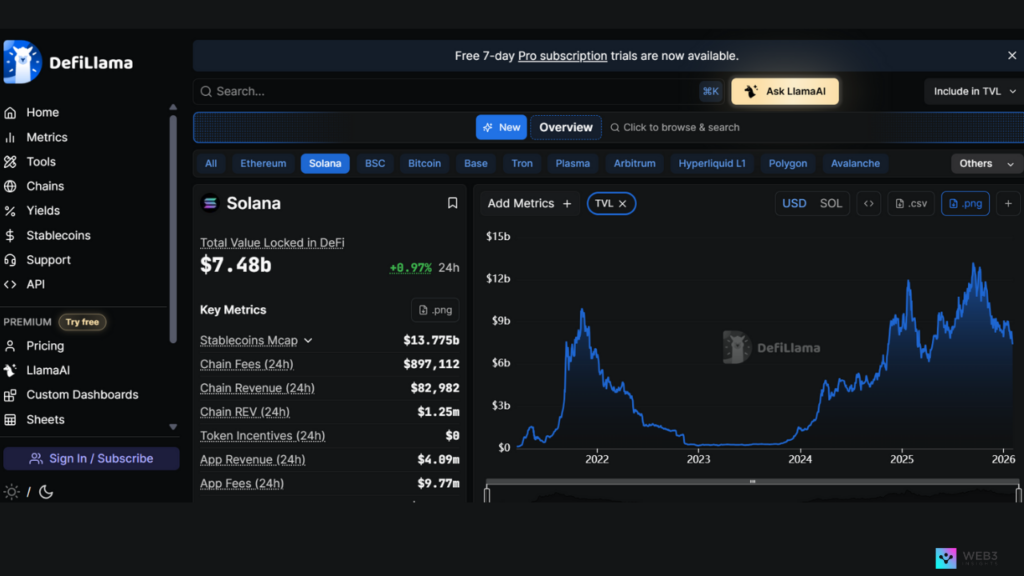

1. Solana (SOL)

Solana stands out as the strongest Bitcoin outperformer in 2026. Its advantage comes from scale: high throughput, low fees, and ecosystem density across memecoins, DeFi, DePIN, and consumer-facing apps.

During alt rotations, SOL consistently acts as the highest-beta large-cap asset. When capital moves out of Bitcoin and into risk, Solana captures that flow faster than most Layer 1s. Its dominance in memecoin activity and DeFi trading volume reinforces this behavior.

SOL’s BTC-relative strength isn’t driven by speculation alone, it reflects real transaction demand and network usage. As long as Solana remains the center of high-velocity on-chain activity, it continues to outperform Bitcoin during expansion phases.

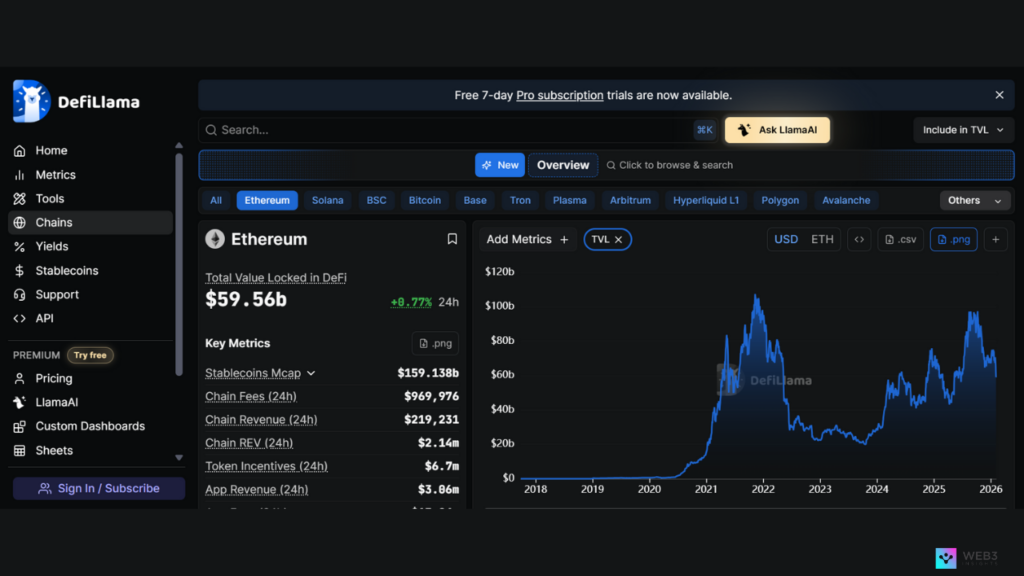

2. ETHEREUM (ETH)

Ethereum’s performance relative to Bitcoin in 2026 is more cyclical but no less important. While ETH can underperform BTC during short consolidation periods, it consistently outperforms during sustained alt expansions.

The drivers are clear: ETF inflows, Layer 2 revenue generation, and the restaking narrative. Ethereum remains the settlement layer for most institutional-facing crypto activity, from DeFi to tokenized assets.

ETH’s strength comes from endurance rather than speed. When capital shifts from defensive positioning into infrastructure exposure, Ethereum reasserts itself as Bitcoin’s primary competitor on a relative basis.

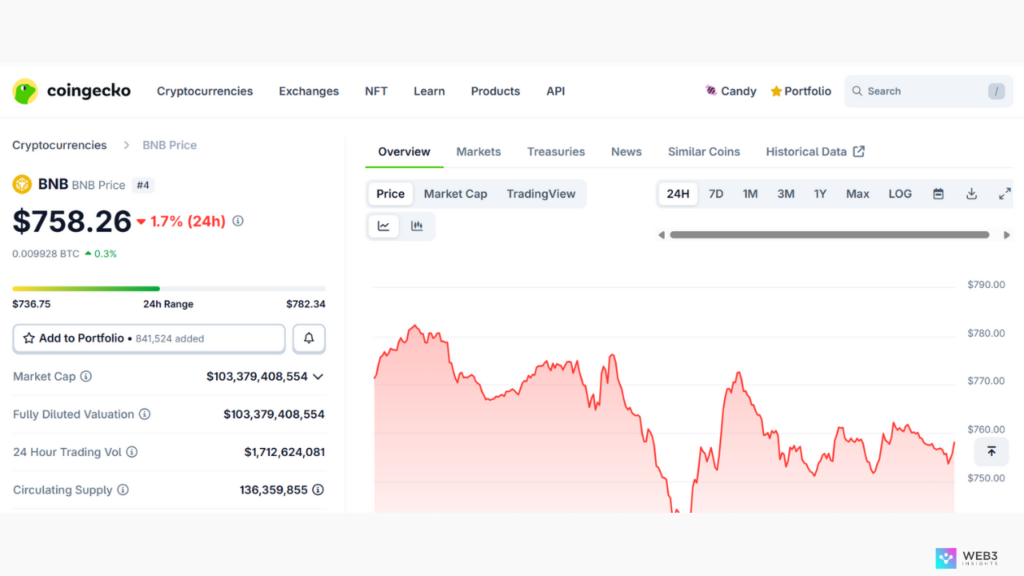

3. BNB CHAIN (BNB)

BNB continues to outperform Bitcoin steadily in 2026, even without aggressive narratives. Its edge lies in exchange-backed liquidity, consistent token burns, and real revenue generated from Binance’s ecosystem.

Unlike many altcoins, BNB benefits directly from trading activity, application usage, and fee capture. This creates a cash-flow-like dynamic that supports its BTC-relative performance, particularly during neutral or moderately bullish market conditions.

BNB may not lead every rotation, but it rarely collapses against Bitcoin, making it one of the most consistent relative performers.

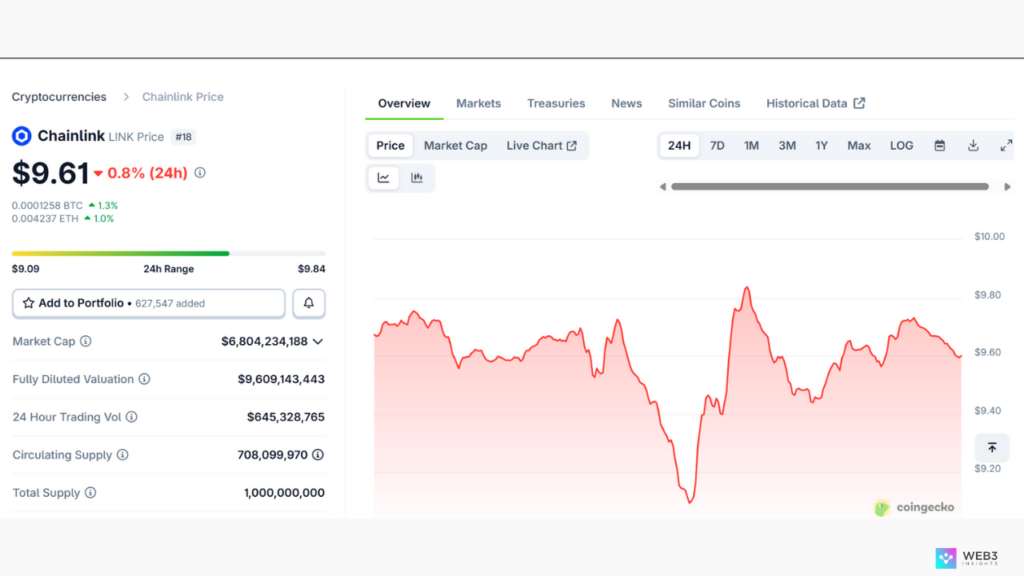

4. CHAINLINK (LINK)

Chainlink’s BTC-relative outperformance in 2026 is tied to its expanding role in real-world assets (RWAs) and cross-chain infrastructure. With CCIP adoption growing and institutional integrations increasing, LINK has become a core infrastructure token rather than a speculative asset.

When markets rotate toward utility-driven narratives, especially tokenization, oracles, and interoperability, Chainlink tends to outperform Bitcoin. Its demand is less retail-driven and more tied to long-term protocol usage.

This makes LINK one of the strongest BTC outperformers during infrastructure-focused market phases.

5. AVALANCHE (AVAX)

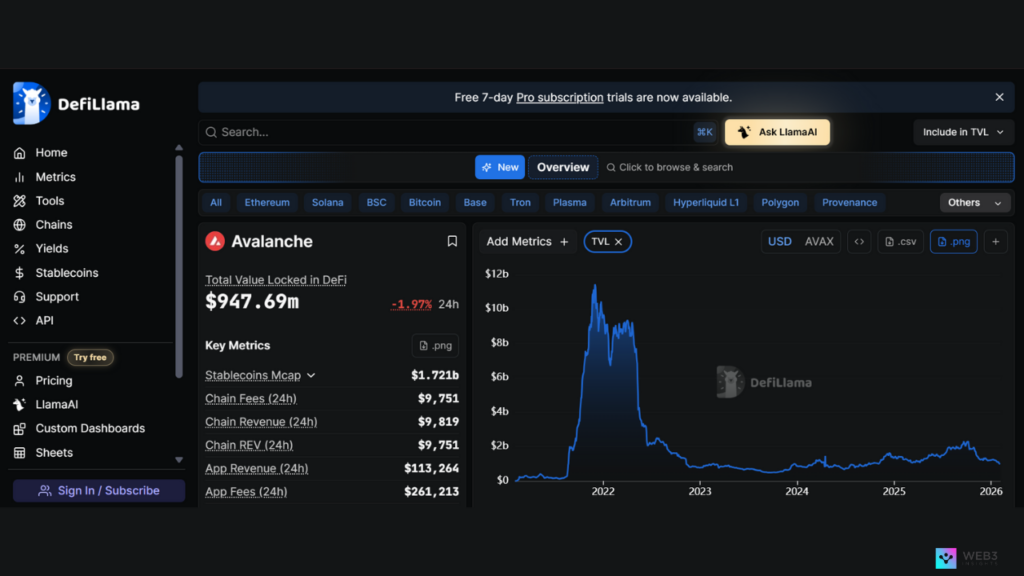

Avalanche’s relative strength against Bitcoin emerges most clearly when real-world asset tokenization and enterprise blockchain adoption trend. Its subnet architecture allows institutions and enterprises to deploy customized blockchains without compromising performance.

AVAX often delivers sharp relative moves during RWA-focused narratives. While it may lag during meme-driven cycles, it excels when capital rotates toward enterprise use cases and scalable infrastructure.

In 2026, this positioning keeps AVAX firmly among the altcoins that outperform BTC when fundamentals take center stage.

What These Metrics Really Tell Us

So what’s the bigger picture here?

For me, these numbers highlight how diverse the altcoin market has become. Each of these tokens is outperforming Bitcoin, but for completely different reasons.

That’s the beauty of altcoins. Bitcoin may be the foundation, but innovation, growth, and adoption often happen elsewhere. And when you put it all together, 2026 is proving that altcoins can be both exciting and rewarding for those willing to watch the right metrics.

Final Thoughts

For me, 2026 has been a reminder of why I love this space. Bitcoin is the king, yes, but it’s the altcoins that bring the surprises, the risks, and the opportunities.

When I look at SOL, ETH, BNB, LINK, and AVAX, I don’t just see random pumps. I see a market that’s maturing in multiple directions at once. From privacy to payments to retail adoption, these projects are carving out their place in crypto history.

Of course, there’s always risk. Altcoins are volatile, and today’s star performer can be tomorrow’s cautionary tale. But as the numbers show, if you’re tracking the right metrics, the upside can be extraordinary.

And that’s why I’ll keep digging into these stories, one metric at a time.