ETF is the quiet workhorse of the investing world, simple, flexible, and built for anyone who wants to grow their money without staring at charts all day.

Think of an ETF as a ready-made investment package that moves like a regular stock. Instead of buying Apple, Microsoft, or Bitcoin one by one, an ETF lets you invest in all of them at once with a single click. That’s the secret: instant access to entire markets, wrapped into one trade.

In 2025, ETFs are no longer just for Wall Street pros. They’ve gone global and digital. Traditional funds now sit side by side with Bitcoin ETFs and Web3-focused ETFs that give investors exposure to blockchain innovation without ever touching crypto wallets. The line between finance and technology has officially blurred.

So, if you’ve been hearing about ETFs and wondering what they really are or why everyone’s suddenly talking about Bitcoin ETFs, you’re in the right place. This blog post breaks it down in plain English, no jargon, no finance degree required.

What Is an ETF?

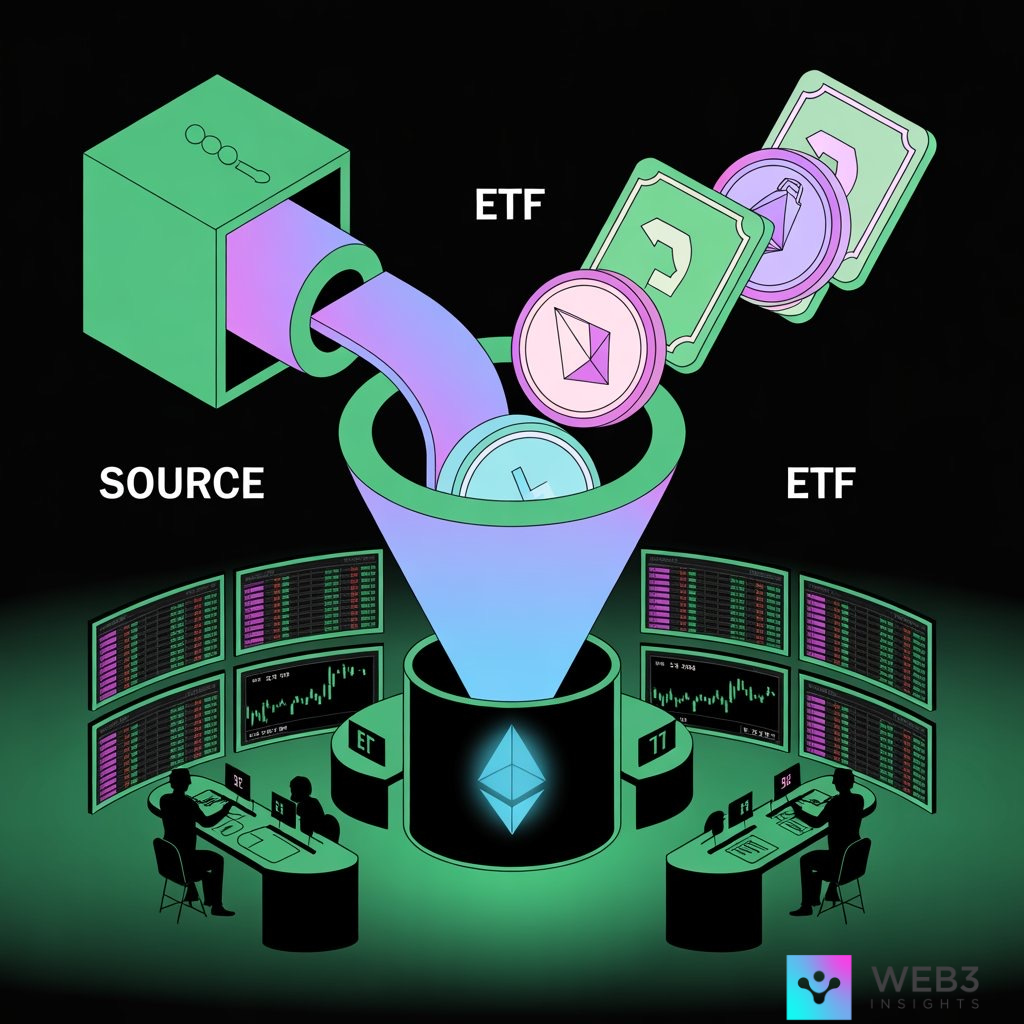

At its core, an ETF, or Exchange-Traded Fund is a simple way to invest in multiple things at once without buying them individually. Picture it like a playlist: instead of listening to one song, you hit play and get a mix of the best tracks across different genres. That’s what an ETF does for your money, it lets you own a curated mix of assets in one go.

Each ETF follows a specific theme or goal. Some track entire markets like the S&P 500, which covers the 500 biggest U.S. companies. Others zoom in on specific areas, like tech stocks, green energy, or now, cryptocurrencies. For example, the SPDR S&P 500 ETF (SPY) mirrors the movement of the S&P 500 index, while BlackRock’s iShares Bitcoin Trust (IBIT) tracks the price of Bitcoin.

The beauty of ETFs is in how flexible they are. You can buy and sell them through your regular brokerage account, just like a normal stock. Their prices move throughout the day, responding instantly to market demand. You’re not locked in; you have full control over when to enter or exit.

What’s changed in 2025 is how diverse ETFs have become. They’re no longer just about stocks and bonds. We now have crypto ETFs, Web3 innovation ETFs, and funds that follow blockchain companies or even tokenized assets. That means you can invest in the growth of digital finance without actually holding digital coins yourself.

Behind the scenes, fund managers or algorithms handle everything: the balancing, tracking, and performance monitoring, so you don’t have to. You just decide your goal, choose an ETF that fits, and let it work in the background.

In short, ETFs are the bridge between traditional investing and the fast-evolving world of Web3. They offer simplicity, variety, and transparency, all in a single trade.

How Do ETFs Work?

Think of an ETF as a box. Inside that box are different assets, stocks, bonds, commodities, or even Bitcoin. When you buy a share of the ETF, you’re not buying everything inside it directly; you’re just owning a slice of the box. That slice represents your share of the total value of everything it holds.

Behind the scenes, there’s a group called authorized participants (APs)/ They are usually big banks or financial institutions. They’re the ones who create or destroy ETF shares based on market demand. If more investors want in, APs go out and buy the underlying assets (say, Bitcoin for a Bitcoin ETF) and deliver them to the fund. The ETF then issues new shares to match. If people are selling, APs do the reverse; they redeem ETF shares and sell off the underlying assets.

This constant balancing act keeps the ETF’s price close to the actual value of the assets inside it, known as the Net Asset Value (NAV). It’s what keeps ETFs honest so they trade in line with what they really represent.

Now, unlike mutual funds (which are priced only once per day), ETFs trade on the stock market all day long, just like Tesla or Apple shares. Their prices rise and fall in real time as investors buy and sell them. This liquidity, being able to enter or exit positions anytime, is what makes ETFs so appealing to both casual investors and pros.

For example, when you buy a Bitcoin ETF like BlackRock’s IBIT, you’re not directly holding Bitcoin yourself. The fund’s custodians do that for you, storing it securely. What you get is exposure to Bitcoin’s price movement without worrying about wallets, private keys, or exchanges.

In the bigger picture, this setup blends the old and new worlds of finance. Traditional infrastructure handles the trading, regulation, and security, while the underlying assets can come from the digital frontier, like Bitcoin, Ethereum, or tokenized gold.

In other words, ETFs take complex markets and make them simple. They let you invest in innovation without touching the messy details of how it all works.

Why Use ETFs?

ETFs have quietly become the investor’s favorite tool, and for good reason. They offer an easy way to get exposure to entire markets or themes without the stress of handpicking individual assets. Instead of chasing winning stocks or timing crypto entries, an ETF lets you ride the broader trend, whether that’s the S&P 500, clean energy, or Bitcoin.

One of their biggest appeals is simplicity. You buy one ETF, and you’re instantly diversified across dozens or even hundreds of holdings. It’s like entering the financial markets through a single door that opens to a full buffet: equities, bonds, commodities, or crypto, all wrapped in one trade.

Then comes cost efficiency. ETFs are known for having some of the lowest management fees in finance, often as little as 0.03%. That means more of your money stays invested and compounds over time. Unlike traditional mutual funds, there’s no lock-in period or surprise costs; you can buy or sell ETFs anytime during market hours, just like stocks.

And in Web3, ETFs are rewriting access altogether. Bitcoin and Ethereum ETFs now let people gain exposure to crypto’s upside without touching wallets, private keys, or exchanges. They merge the familiarity of traditional investing with the innovation of blockchain. For many investors, it’s the simplest on-ramp to digital assets, regulated, transparent, and accessible with just a few clicks.

In short, ETFs are the modern investor’s bridge, connecting traditional finance and Web3, risk management and growth, all in one fluid form.

FAQ: Understanding ETFs

What does ETF stand for?

ETF stands for Exchange-Traded Fund, a type of investment fund that trades on the stock and crypto market, just like a regular stock or crypto.

How are ETFs priced?

ETFs have a market price that fluctuates throughout the trading day, based on supply and demand. Behind the scenes, they track a “net asset value” (NAV) that reflects the value of their underlying assets.

What’s the difference between ETFs and stocks?

A stock gives you ownership in one company. An ETF, on the other hand, gives you exposure to a whole group of assets, like a mix of companies, or even cryptocurrencies, through a single trade.

Are ETFs good for beginners?

Absolutely. ETFs are simple, affordable, and diversified by design, making them ideal for investors who want to start without managing multiple assets or worrying about constant rebalancing.

Can I invest in crypto using ETFs?

Yes. Bitcoin and Ethereum ETFs now let you gain crypto exposure directly through traditional brokerages, no wallets or private keys required. It’s a regulated way to tap into digital assets.

Do ETFs pay dividends?

Many do. When the companies or assets inside an ETF pay dividends, those earnings are usually distributed to ETF holders, just like with regular stocks.

Conclusion

ETFs have evolved from a niche investing tool into one of the most powerful forces in global finance. They make investing simple for beginners yet efficient enough for professionals. Instead of juggling multiple assets or second-guessing market timing, ETFs let you participate in entire sectors, or even digital ecosystems through a single trade.

In 2025, their relevance is stronger than ever. Traditional ETFs continue to anchor portfolios around the world, while crypto ETFs are opening a regulated gateway into the Web3 economy. You can now gain exposure to Bitcoin, Ethereum, or blockchain innovation, all from the same brokerage account where you buy your regular ETFs.

That blend of accessibility, transparency, and innovation is what makes ETFs timeless. They’re not just a financial product; they’re a bridge between where finance has been and where it’s going next.